Please be informed that the Continuing Professional Development is organising the above titled seminar.

The seminar will cover:

- key tax principles in distinguishing between disposals of real property on capital account and revenue account

- what does the Revenue look for in tax audits relating to disposals of land?

- what are the badges of trade?

- legal advice vs accounting advice

- what should taxpayers do when faced with tax audits or investigations into land transactions?

- what are tax avoidance schemes and can they apply in land transactions?

- tax cases and practical tips

Particulars of the Seminar are as follows:

| Date | 4TH AUGUST 2023 (FRIDAY) |

| Time | 2:45 P.M. – 4:45 P.M. |

| Venue | LEVEL 1, ABDULLAH A. RAHMAN AUDITORIUM JOHORE BAR BUILDING NO. 5 JALAN TUN ABDUL RAZAK SUSUR 1/1 80000 JOHOR BAHRU |

| Fees | RM60-00 FOR MEMBERS OF THE MALAYSIAN BAR RM30-00 FOR PUPILS IN CHAMBERS / LAW STUDENTS |

| CPD code | T5/04082023/JHB/JHB213497/2 [2 points] |

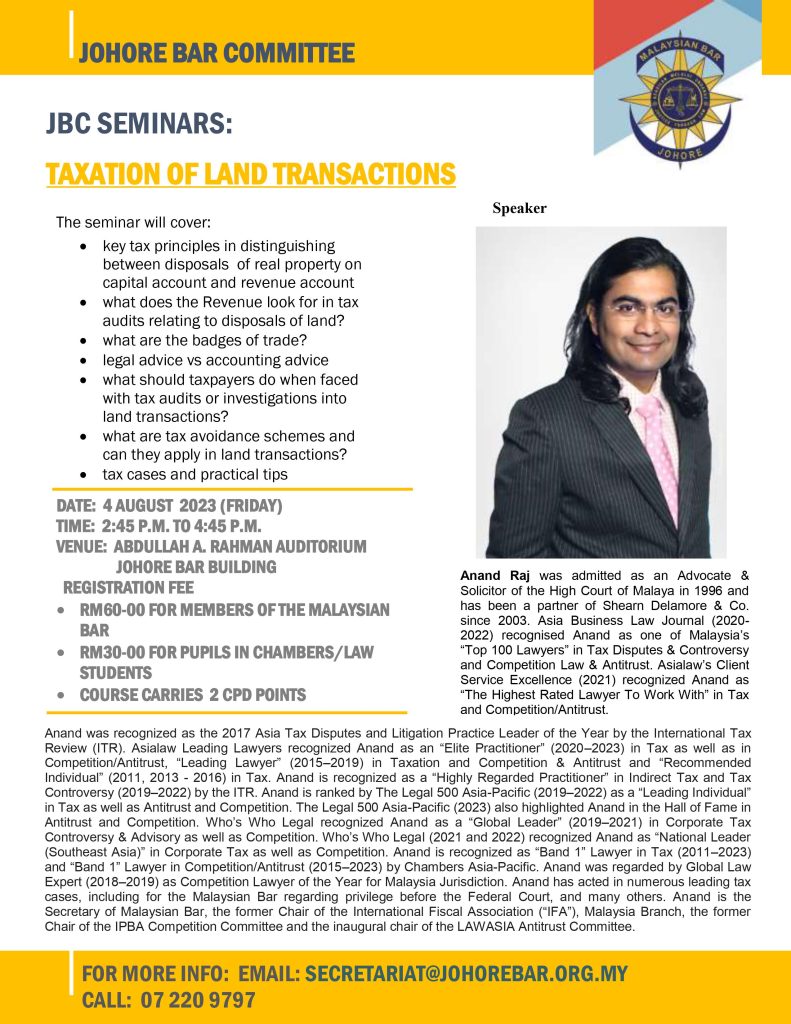

About the Speaker

Anand Raj was admitted as an Advocate & Solicitor of the High Court of Malaya in 1996 and has been a partner of Shearn Delamore & Co. since 2003. Asia Business Law Journal (2020-2022) recognised Anand as one of Malaysia’s “Top 100 Lawyers” in Tax Disputes & Controversy and Competition Law & Antitrust. Asialaw’s Client Service Excellence (2021) recognized Anand as “The Highest Rated Lawyer To Work With” in Tax and Competition/Antitrust. Anand was recognized as the 2017 Asia Tax Disputes and Litigation Practice Leader of the Year by the International Tax Review (ITR). Asialaw Leading Lawyers recognized Anand as an “Elite Practitioner” (2020–2023) in Tax as well as in Competition/Antitrust, “Leading Lawyer” (2015–2019) in Taxation and Competition & Antitrust and “Recommended Individual” (2011, 2013 – 2016) in Tax. Anand is recognized as a “Highly Regarded Practitioner” in Indirect Tax and Tax Controversy (2019–2022) by the ITR. Anand is ranked by The Legal 500 Asia-Pacific (2019–2022) as a “Leading Individual” in Tax as well as Antitrust and Competition. The Legal 500 Asia-Pacific (2023) also highlighted Anand in the Hall of Fame in Antitrust and Competition. Who’s Who Legal recognized Anand as a “Global Leader” (2019–2021) in Corporate Tax Controversy & Advisory as well as Competition. Who’s Who Legal (2021 and 2022) recognized Anand as “National Leader (Southeast Asia)” in Corporate Tax as well as Competition. Anand is recognized as “Band 1” Lawyer in Tax (2011–2023) and “Band 1” Lawyer in Competition/Antitrust (2015–2023) by Chambers Asia-Pacific. Anand was regarded by Global Law Expert (2018–2019) as Competition Lawyer of the Year for Malaysia Jurisdiction. Anand has acted in numerous leading tax cases, including for the Malaysian Bar regarding privilege before the Federal Court, and many others. Anand is the Secretary of Malaysian Bar, the former Chair of the International Fiscal Association (“IFA”), Malaysia Branch, the former Chair of the IPBA Competition Committee and the inaugural chair of the LAWASIA Antitrust Committee.

Payment Registration

Registration must be accompanied with proof of payment to guarantee your participation in the seminar on a first come first served basis.

To register, please submit ALONG WITH PROOF OF PAYMENT, the following details by email to the Johore Bar Secretariat(secretariat@johorebar.org.my)on or before 3rd August 2023 (Thursday):

- Name of participant(s);

- Name of legal firm;

- Membership Number / Petition Number; and

- Email address:

Payment can be made by direct deposit or internet banking to:

Account name: JOHORE BAR HOUSE & LIBRARY FUND

Bank: CIMB Bank Berhad

Account no.: 80-0933164-8

Please note that CPD points will be given only to participants who attend the Seminar from start till the end.

AIMI SYARIZAD BINTI DATUK HJ. KUTHUBUL ZAMAN

CHAIRPERSON

CONTINUING PROFESSIONAL DEVELOPMENT SUB COMMITTEE